GNFR Spend Optimization in the Retail Industry

Hersh Agarwal & Ethan Chang, Proacure Research Team | June 21, 2022

GNFR accounts for 20-30% of a retailer’s operating costs but is seen as less relevant and having a lesser influence on organization’s performance. Businesses must have total insight into supplier relationships and sales performance in order to achieve success beyond imagination.

The “Core” of Retail

The success of a retail store depends on satisfying customer needs, i.e., the right product available, at the right time, at the right price, and in the right place. The merchandiser must plan, forecast, source, and budget the products available on retail shelves to this end.

Sourcing then becomes an integral part of the merchandiser’s job, to procure products from suppliers at reasonable prices and sell them to consumers at prices with a profit margin to ensure the success of the retail initiative. The merchandiser then must have access to data regarding suppliers, fees charged, sales data from retail outlets, consumer demographic patterns, buying behavior and a lot more.

Supplier selection and supplier relationship are some of the critical success attributes in retail. In making decisions, several factors need to be considered like,

- Reliability of the supplier including compliance with legal requirements, sustainability initiatives and ethics

- The price at which the product is being offered

- The delivery lead time maintained by the supplier to forecast planning and inventory

- The risk involved with suppliers, including financial strength assessment.

This is where digital sourcing comes in. Aggregating the data in one place with clear visibility of spending allows merchandisers to plan and budget accurately, prevent stock-outs, maintain variety and assortment of products and ensure maximum net income.

Procurement Cost Analysis in Retail

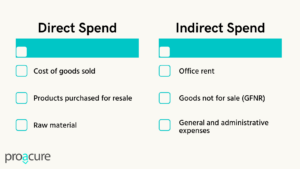

In retail, like in other industries, cost analysis regarding procurement functions follows two different categories, direct spend and indirect spend.

- Direct spend: expenditures of the business on items that will ultimately be sold to end consumers or expenses that are directly related to revenue for the company. In retail, direct spending will be GFR (Goods for Resale) like food, groceries, personal care items etc., the things that end consumers will buy.

- Indirect spend: the non-revenue generating expenditures like office rent or supplies that help in the day-to-day running of the business. In the retail industry, this is GNFR Spend ( Goods not for resale) , goods and services that are not resold to the end consumer. GNFR spend would include packaging materials, cash registers, cleaning supplies, printer paper, signage, shelving or advertising expenditures.

Amongst cost management practices, a should-cost analysis (also called cost breakdown analysis, clean sheet costing or open-book costing) is followed for direct spending. In contrast, for indirect spending, zero-based budgeting is more preferable.

Optimizing Indirect Spend in Retail

A McKinsey report titled ‘Beyond Procurement: Transforming Indirect Spend in Retail’ mentions that indirect spending can comprise up to 10-15% of sales on average and are far from optimized.

Controlling indirect spending requires spend visibility. Siloed procurement treatments in GNFR categories prevent optimization of indirect spend, which could contribute significantly to cost savings, up to 1-2% of return on sales.

Procurement, especially procurement analytics and digital sourcing capabilities involving data insights and fact-based decision-making, can contribute significantly towards retail marketing’s efforts towards managing indirect spending. Two areas of improvement –

- Spend visibility: AI-ML powered digital solutions providing retailers with visibility into who spends what in which category

- Spend control: Digital Procure-to-Pay tools to allow retailers more control over supplier selection and approval

GNFR Spend is seen as the expenditure needed by the retailer to function and is often overlooked or under-controlled. However, GNFR, if spent optimally, can also influence consumer purchase decisions to a significant extent, for example,

- Physical evidence: Infrastructure, store ambience, lighting and furnishing has a positive impact on purchase decisions

- Optimized IT infrastructure helps monitor seasonality, cyclicity and other sales data. It helps accurately forecast purchase patterns for optimal procurement and merchandising decisions. IT systems also aid smart checkout and payment solutions along with tailored promotions

- Automated supply chains and logistics optimization along with customer deliveries to prevent disruptions and manage risks.

- In-store and outdoor signage and advertising along with optimization of shelf space with merchandising software.

Managing unnecessary GNFR spend requires spending visibility. It enables the organization to align expenditures to strategic goals, buy cheaper (cost-leadership organizations can review and reduce per-unit costs), buy smarter (organizations focusing on differentiation can optimize digital systems to reduce costs), or buy less.

Consolidating suppliers with KPI-driven agreements instead of dealing with numerous small, non-compliant suppliers can also provide avenues for tail spend management.

Procurement and the Rise of Private Labels

Retail does not simply entail storing the products from different manufacturers. Several retailers are now foraying into private labels. For example, the French sport retailer, ‘Decathlon’, has firmly established its own labels during the last two decades and continues to launch more.

For private labels, the sourcing and procurement need for in-house production calls for a shift in how retail has hitherto viewed procurement, making it a more complex process.

When manufacturers are separate from retailers, the retailer can pass on prices to the consumer. However, in-house production demands control, capacity utilization and optimization of the entire supply chain by the retailer.

Procurement must sync with other functions, like product development, category management, and supply-chain management. The procurement officer now performs the job performed by the merchandiser. A detailed understanding of the value-creating capacity of the product, the prices and purchase preferences are required. The procurement officer must also know the costs and suppliers dealing in raw material for these products at various stages of the organizational value chain. Procurement then becomes an end-to-end function.

Marketing and Procurement in Retail

Today’s retailers compete in a volatile industry with razor-thin profit margins. With the proliferation of digital media, the marketing function has undergone a sea of change. There is no one customer journey or a predetermined sales funnel. Consumers gather information about brands from various offline and online channels and inspect virtual and physical retail outlets before making a purchase.

By launching their own private labels and finer segmentation, retailers satisfy a larger customer base and build a strong brand image for each with marketing strategies tailored for the target segments.

The synergies between marketing and procurement can be expressed through,

- Supplier management: Selection of financially viable suppliers and negotiation of competitive rates.

- Efficiency: Reviewing efficiencies of agencies and suppliers through auditing and monitoring

- Analytical capabilities: Finding the right channel for targeted promotions through visibility of purchase patterns and ad performance

Conclusion

Now more than ever, procurement needs new analytical capabilities to pull insights from complex data sets. To compete, businesses must have complete visibility into supplier relationships and sales performance in order to eliminate leakage and improve operations.

Proacure is a procurement technology & data-science organization based in the San Francisco Bay Area. Our ‘Koreografy’ model leverages multiple frameworks like congruence of different data sets, fusion of digital, analytics and business processes, and synchronous collaboration between various stakeholders. The model enables 100% Spend Visibility with prescriptive actionable insights to transform Strategic Sourcing and help realize untapped value in the Supplier and Tail Spend. Proacure’s deliverables include cost savings of 7-30%, a 20%+ increase in EBITDA, cash flow optimization, and reduced supply-chain disruption.

Related Articles