Zero-Based Budgeting to Optimize Costs for enhanced EBITDA.

Zero Based Budgeting is based on the principle that expenses must be justified for each new period based on demonstrable needs. Funding is allocated based on program efficiency and necessity rather than budget history. This approach includes capital expenditures, operating expenses, sales, general, and administrative costs, marketing costs, or cost of goods sold. It is a simple and yet powerful concept to strip out any unjustifiable spend and align company spending with strategic goals. This is an invaluable leadership and transformation tool not only to optimize costs and efficiency but also to energize employees, improve resource planning and organizational collaboration.

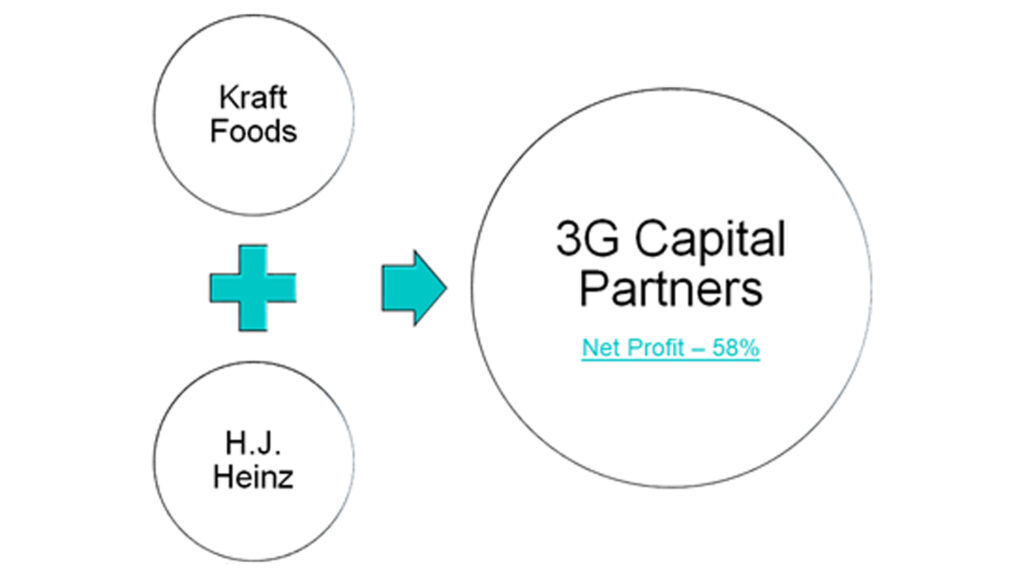

It recently became popular due to the huge success of PE firms implementing it. After 3G Capital Partners acquired Kraft Foods and H.J. Heinz to merge into a single entity, they utilized zero based-budgeting which led to a 58% increase in net profit.

At the time, the food industry average net profit was 16%, they were able to achieve a net profit of 28%. This motivated companies to look at ZBB for optimizing costs in the age of volatile and uncertain market conditions.

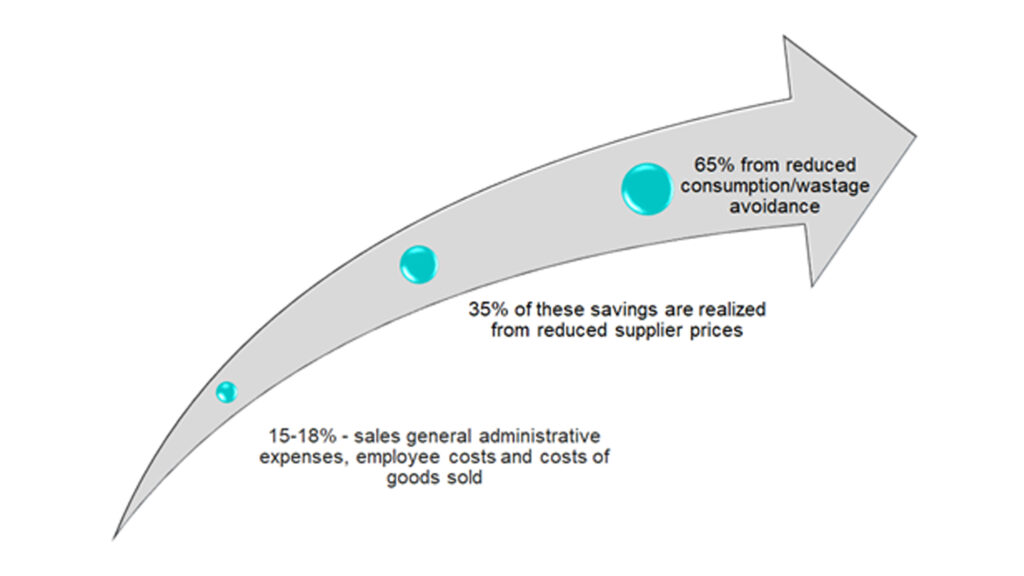

Accenture Strategy conducted a research on zero-based thinking involving 85 biggest global companies across industries from banking and retail to CPG and life sciences. The research found that only 2% of the organizations adopted ZBB before 2011. However, from 2013, ZBB adoption has grown exponentially by 57% each year, with over 91% of the companies fully meeting or exceeding their program targets. This approach has helped firms drastically optimize costs and bring savings to the bottom line. The average cost reduction was 15-18% across sales general administrative expenses, employee costs and costs of goods sold. 35% of these savings are realized from reduced supplier prices, while 65% from reduced consumption/wastage avoidance.

Impact of ZBB on Firms

ZBB inculcates a culture of ownership and cost control which puts the organization into an orbit of innovation and growth. With involvement of senior management and leadership, ZBB acts as a catalyst for cost-conscious transformation. It helps build the finance, procurement and human resources capabilities to find savings and reinvest in driving operations efficiency and achieve enhanced revenues and EBIT.

Bain & Co. stipulates that “ZBB results in dramatically simplified processes, with fewer steps, fewer meetings and fewer people attending meetings.” They found that “a zero-based approach might be the right answer if a company lacks expense visibility needed to make cost trade-off and reduction decisions.

However, ZBB implementation does pose challenges. Accenture research found that during a ZBB project, cultural buy-in and data visibility were the hardest obstacles to overcome. The study found that 20-35% of the spend was not categorized properly which resulted in missed opportunities for savings while implementing ZBB.

How can Proacure help?

Proacure Spend Cube helps with spend categorization, cost visibility and value targeting opportunities in a ZBB project. Our ZBB dashboards provide a granular view of SG&A spend visualization across business units, categories and suppliers, and highlight underlying drivers of spending. This provides internal benchmarks, best practices and gives the firm an understanding of spending levels that help them work towards optimized budget allocation. In addition, the Spend Cube analyzes consumption and opportunities for value engineering, thereby providing inputs for strategic sourcing to optimize supplier costs.